Blockchains 101

A blockchain is a decentralized, distributed and publicly viewable digital ledger that is used to record transactions across many independent computers.

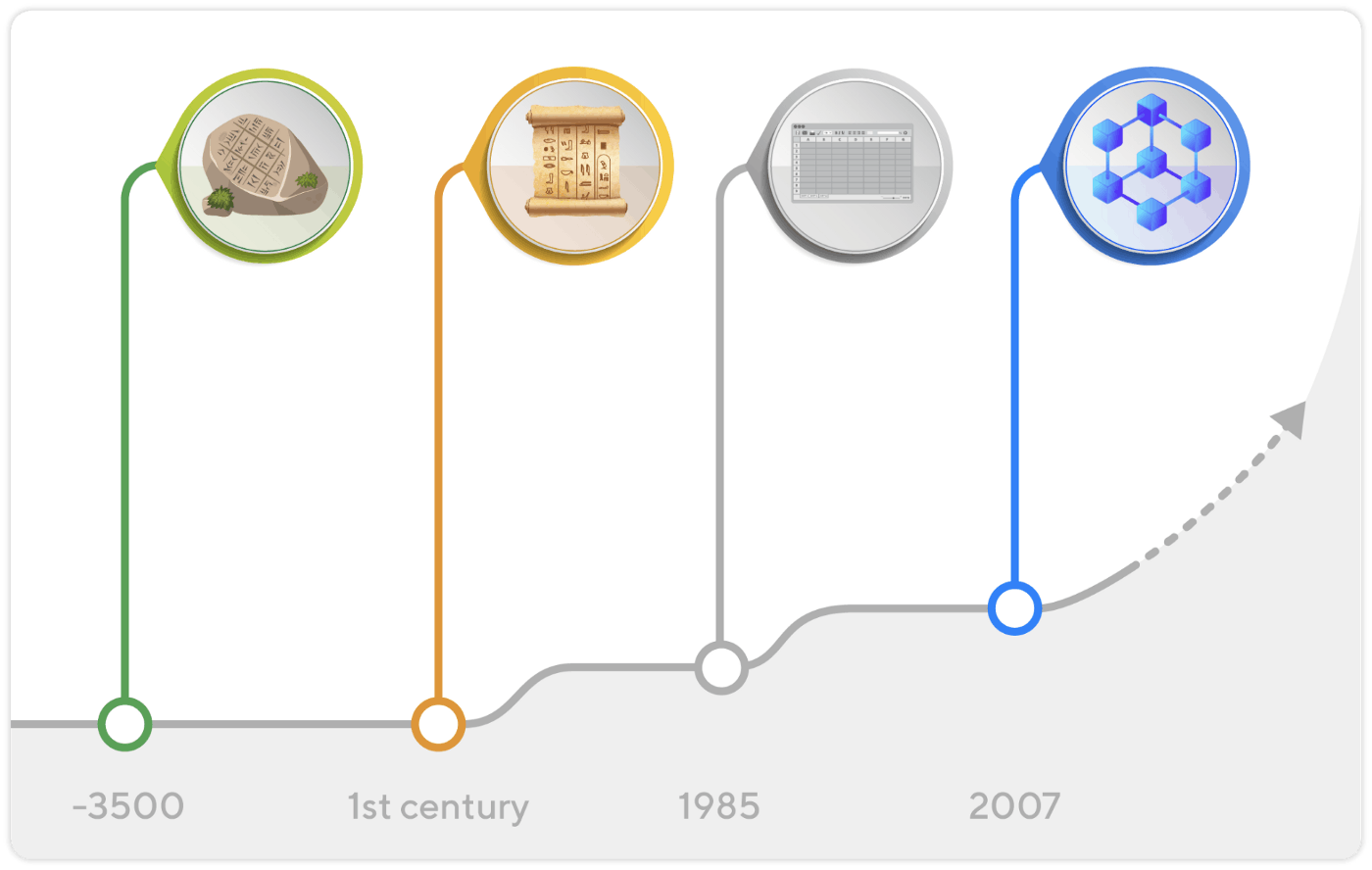

How Ledgers Rule the World

Our modern world revolves around lists of various types, ranging from property ownership records to accounting of money in the bank. Some of the earliest human writings appear to be lists of resources owed to governments and individuals. These early lists (e.g., Joe owes Rebecca 5 cows) are known as single entry accounting.

The next revolution in lists occurred thousands of years later when the Medici family developed double entry accounting, leading to an incredible rise of power within the Republic of Florence, and the Florin becoming the de facto world reserve currency. Double entry accounting is powerful because it significantly reduces errors and also gives a holistic reporting of the entity’s finances. Double entry accounting is still used today in modern-day accounting systems.

The next major breakthrough in accounting arrived in 2009, when bitcoin solved the byzantine generals problem and created triple entry accounting. The third entry is the global state of the ledger, which all participants can agree to independently. Bitcoin is a new type of ledger with a single global state shared by all participants without the need for a central party in control. This type of system was later rebranded to “Blockchain Technology”.

What is a Blockchain?

A blockchain is a decentralized, distributed and publicly viewable digital ledger that is used to record transactions across many independent computers. Modifications to the ledger can only be made when all nodes agree that the network rules have been followed. This keeps assets from being stolen by bad actors without the need for a central entity. Bitcoin, the earliest form of blockchain, was a very simple system with only the function to send and receive Bitcoins. Blockchains now include other advanced functions such as borrowing, lending, swapping and NFT's. These blockchains with advanced functionality are known as Smart Contracting Blockchains.

Where Do Blockchains Excel?

Blockchains provide immutable property rights to users, making it impossible to delete or modify data that have been recorded. These distributed networks preserve the rules of the system even when under attack by people trying to lie, cheat or steal.

Blockchains provide censorship resistance to users due to their distributed nature. In financial systems of the past, you can be excluded if the single controller of the system decides you should no longer have access to your funds. However, in blockchain systems, you only need a single validating node within the network to accept your transaction. Users include fees to the validators / miners to ensure economic incentives can overcome any attempts to censor.

An additional benefit to the distributed nature of blockchains is the redundancy of the data. For the first time, participants can independently verify the blockchain’s history and agree on the current balances independently. Every additional node in the network becomes a new copy of the list distributed across the globe. Making the network as a whole much more resilient to downtime, failures of any group or cataclysmic events.

Last, but not least, blockchains provide transparency and traceability to the financial system. The traditional finance world is full of ledgers, mostly hidden from plain sight. This leads to fiascos like FTX , Celsius and Lehman Brothers. The risk within a private ledger system can be hidden until the very last minute before everything collapses. A perfect example of risk transparency can be found in the final days of the Celsius fractional reserve collapsing. Their debts to decentralized protocols were some of the first they paid back, long before their centralized finance counterparts realized the extent of the balance sheet damage. This is mostly due to the overcollateralized nature of Defi lending & the radical transparency the blockchain provides.

Where Do Blockchains Struggle?

While blockchains provide some incredible properties, there are serious tradeoffs that need to be considered.

The censorship resistance and failure tolerance of blockchains comes from redundant computers. Due to this overhead of running many computers, they can not be as scalable as a single computer or data center. These distributed computers also need to communicate and achieve agreement before the entire network can continue to function.

Because the blockchain is independent from a central entity, blockchains require a large amount of economic security to reach consensus. Bitcoin uses Proof of Work to gain this economic security, and the amount of work required for BTC to reach consensus is incredibly large. Many other blockchain systems use Proof of Stake to acquire this economic security of the network. However, Proof of Stake networks have their own issues around cartelization and corruption within the stakeholders.

Last but not least, due to its nascent state, blockchains have notoriously difficult UX challenges that are yet to be solved. These revolve around the difficulty of key management, submitting transactions to networks through signing devices and proper crypto security practices. We seem to be years away from onboarding casual users.

Conclusion

Blockchains are an incredible technology that bring sovereignty to people's finances across the globe, but they have inherent challenges. Saga engineers are working hard to minimize the known issues with blockchains by improving the UX and scalability of these networks while maintaining the amazing properties that have led to the explosion of blockchain and cryptocurrency adoption over the last 10 years.